Architecture

Router Protocol is built on the concept of a programmable execution graph: a dynamic network where bridges, DEXs, solvers, and messaging protocols act as nodes and edges, enabling unified, fault-tolerant cross-chain workflows.

Programmable Execution Graph

The defining idea of Router Protocol is that of a programmable execution graph: a dynamic network where bridges, DEXs, solvers, and messaging protocols act as nodes and edges, enabling unified, fault-tolerant cross-chain workflows. In contrast to earlier systems where execution was locked into monolithic paths, Router's graph-based architecture enables dynamic routing and composability.

Core Primitives

Router OGA consists of six core primitives that work together to provide efficient, reliable cross-chain execution:

1. Permissionless Node Registry & Reputation

Instantly onboards bridges, DEXs, and solver nodes under EIP-712 authentication, with on-chain reputation scoring to favor reliable execution.

Key Features:

- EIP-712 Authentication: Secure, standardized node onboarding

- On-chain Reputation Scoring: Real-time reputation tracking to favor reliable execution

- Permissionless: Anyone can register a node and participate in the network

- Dynamic Discovery: Nodes are discovered and registered automatically

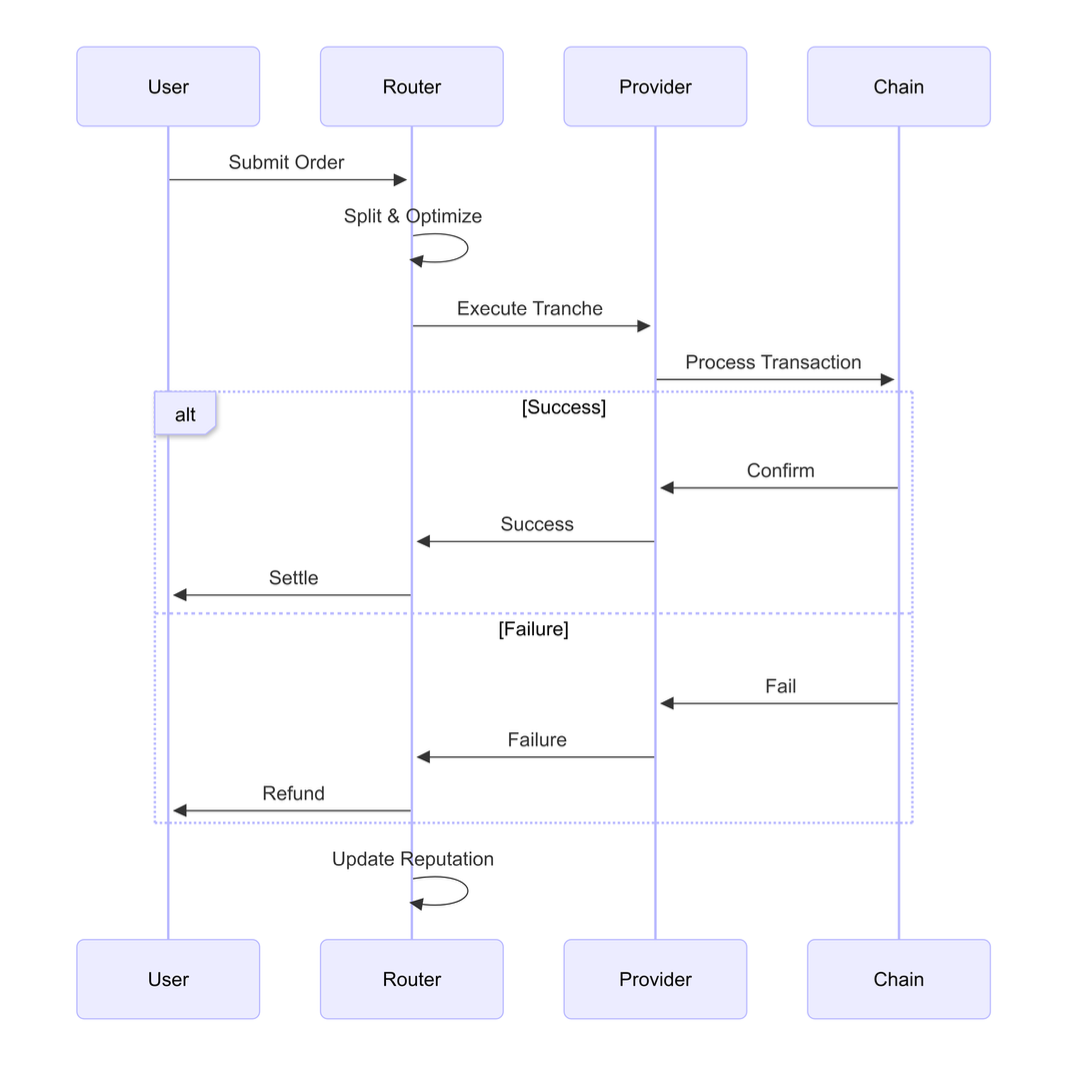

2. Split-and-Optimize Engine

Parallelizes large orders into sub-tranches across multiple venues, achieving sub-10 bps slippage on trades up to $50 million.

How it Works:

- Order Splitting: Large orders are automatically split into optimal sub-tranches

- Parallel Execution: Sub-tranches execute in parallel across multiple venues

- Cost Optimization: Real-time calculation of splitting benefits versus additional gas

- Scale Benefits: Larger network creates compounding benefits through economies of scale

Benefits:

- Sub-10 bps execution costs on block-size trades

- Handles trades up to $50 million

- Optimal capital allocation across venues

- Reduced slippage through parallel execution

3. Unified Messaging Hub & Isolated Revert Logic

Adapts between cross-chain protocols (LayerZero, Wormhole, etc.) at runtime and confines failures to individual hops, reducing end-to-end revert risk below 0.5%.

Key Features:

- Protocol Adaptation: Automatically adapts between different cross-chain messaging protocols

- Isolated Revert Logic: Failures are confined to individual hops, not the entire transaction

- Partial Execution: Users receive partial execution benefits even when some infrastructure fails

- Fault Tolerance: System continues operating even when individual nodes fail

Security Benefits:

- Reduced Exposure: Users receive partial execution benefits even when some infrastructure is compromised

- Limited Attack Rewards: Per-tranche isolation caps the maximum economic benefit of attacks

- Lower Revert Risk: End-to-end revert risk reduced below 0.5%

4. Modular Hook Architecture

Exposes on-chain hooks for dynamic fee modules, governance-driven routing policies, and custom workflows—enabling seamless integration with developer SDKs and composable order NFTs.

Capabilities:

- Dynamic Fee Modules: Customizable fee structures

- Governance-driven Routing: Community-controlled routing policies

- Custom Workflows: Build custom execution flows

- Composable Order NFTs: Represent orders as NFTs for composability

- SDK Integration: Seamless integration with developer tools

5. Execution & Liquidity Oracles

Provides time-weighted average execution cost and on-chain liquidity metrics to power automated risk management and back-testing.

Features:

- Execution Cost Metrics: Time-weighted average execution costs

- Liquidity Metrics: Real-time on-chain liquidity data

- Risk Management: Power automated risk management systems

- Back-testing: Historical data for strategy validation

6. Real-time Reputation System

Tracks node performance in real-time and adjusts routing preferences accordingly.

Components:

- Performance Tracking: Monitor success rates, execution times, and costs

- Dynamic Scoring: Real-time reputation updates

- Routing Optimization: Automatically favor high-performing nodes

- Network Health: Overall network performance monitoring

Architecture Benefits

For Institutions & Professional Traders

- Large Order Handling: Execute block-size trades (≥$5 million) with minimal slippage

- Reliability: 99.5% settlement reliability ensures trades complete successfully

- Cost Efficiency: Sub-10 bps execution costs reduce trading overhead

- Risk Management: Isolated revert logic limits exposure

For DeFi Protocols

- Composability: Modular hook architecture enables custom workflows

- Integration: Easy integration with existing DeFi infrastructure

- Flexibility: Adapt to different cross-chain messaging protocols

- Scalability: Network grows with more nodes, improving performance

For Node Operators

- Permissionless: Anyone can register and operate a node

- Competition: Healthy competition drives innovation and cost reduction

- Reputation: Build reputation through reliable execution

- Economic Benefits: Participate in network growth and fee distribution

Network Effects

As the network grows, all participants benefit:

- Competition Benefits: Increased node competition drives down costs and improves service quality

- Liquidity Benefits: More nodes mean deeper liquidity pools

- Reliability Benefits: More nodes provide redundancy and fault tolerance

- Ecosystem Benefits: Better execution efficiency benefits all DeFi participants

Technical Specifications

- Node Integration Overhead: ~100 lines of smart-contract code

- Settlement Reliability: 99.5% across five live chains

- Execution Costs: Sub-10 bps on block-size trades

- Revert Risk: <0.5% end-to-end revert risk

- Trade Capacity: Up to $50 million per trade

- Supported Protocols: LayerZero, Wormhole, and other cross-chain messaging protocols

Next Steps

- Learn about Supported Chains

- Explore the API Reference to start integrating

- Check out Integrate Into OGA to add your node